AI Boom Ignites a Trillion-Dollar Build Supercycle

📣 Announcement: TheMinerMag rebrands to TheEnergyMag

A quick note before we dive in: TheMinerMag is now TheEnergyMag.

What began as focused coverage of Bitcoin mining has expanded into something broader. AI-driven data center demand is reshaping utilities, capital markets and long-term infrastructure investment. The center of gravity has shifted from pure hashrate to power.

TheEnergyMag reflects that evolution. Read more here.

The scale of capital now flowing into AI infrastructure is starting to look less like a typical tech upcycle and more like a generational buildout — one that stretches from Bitcoin miners to regulated utilities to Big Tech itself.

Over the past few weeks alone, we’ve seen a rare 100-year bond, a Bitcoin mining giant deploy more capital in one year than it spent in the three years after its IPO — and two of the largest U.S. utilities line up tens of billions in regulated investment and fresh debt to support rising data center load.

This isn’t incremental expansion. It’s a balance-sheet shift.

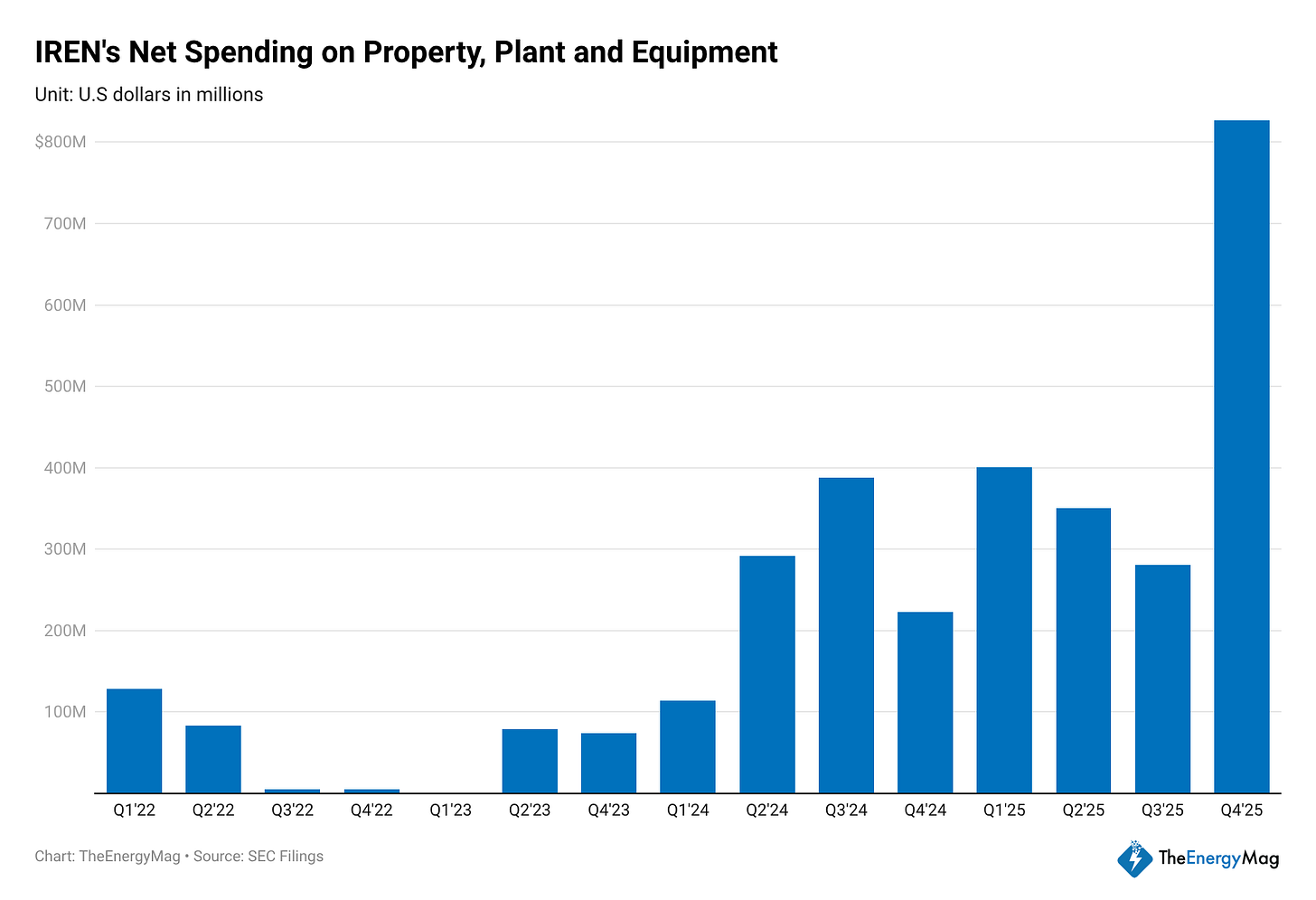

IREN’s spending curve bends sharply upward

Start with IREN.

In its latest quarter, net spending on property, plant and equipment topped $800 million — significantly above prior quarters. But the annual view is even more telling: IREN’s total net PP&E spending in 2025 alone exceeded the combined total from 2022 through 2024.

In practical terms, the company deployed more capital in a single year, building AI data center infrastructure and procuring GPU hardware than it spent across three years expanding its Bitcoin mining fleet post-IPO, according to TheEnergyMag’s analysis.

That shift highlights how different the AI buildout looks from the last mining cycle. High-density GPU clusters, substation upgrades, advanced cooling and long-duration interconnections resemble utility-scale infrastructure more than modular ASIC deployments. The capex profile follows accordingly.

Duke’s $103B plan — and the load behind it

On the utility side, Duke Energy is openly framing this as a multi-year expansion cycle.

The company outlined a $103 billion five-year capital plan, which CEO Harry Sideris described during the earnings call as “the largest fully-regulated capital plan in the industry focused on critical energy infrastructure investments that strengthen the system and serve increasing load.”

That “increasing load” is tied in part to AI and advanced manufacturing demand.

Sideris also stressed that as investment needs accelerate, “the cost of energy has been and will remain a key focus for Duke Energy.” In a news release accompanying the results, he said the company is entering the year “with incredible momentum,” adding that the fundamentals of the business “have never been stronger” and pointing to operations in some of the most attractive jurisdictions in the country.

In 2025 alone, Duke broke ground on 5 gigawatts of new dispatchable generation. Management extended its long-term adjusted EPS growth target of 5% to 7% through 2030, supported in part by contracted demand.

The quarterly results also reflected the other side of heavy capital spending: higher depreciation and interest expense tied to a growing asset base.

NextEra Energy has been equally active in capital markets.

On Feb. 7, it announced raising $1.3 billion in new debt across two tranches. On Feb. 10, its subsidiary issued another €1.3 billion in euro-denominated debentures. The structure — blending intermediate and long-dated maturities — mirrors how large utilities fund long-lived generation and grid assets.

While proceeds were not specifically itemized, the activity comes as NextEra expands its partnership with Google Cloud to co-develop multiple gigawatt-scale data center campuses in the U.S., including land, interconnection and dedicated generation resources.

Google sells a century

At the other end of the stack, Alphabet Inc. — parent of Google — sold a rare 100-year bond as part of a $31.51 billion global debt raise.

The century tranche raised 1 billion pounds at a 6.125% coupon and reportedly drew demand nearly ten times the amount offered. The broader transaction included sterling, Swiss franc and U.S. dollar bonds, with maturities stretching from three years out to 2066.

Century bonds are typically associated with governments or regulated utilities. Analysts noted that ultra-long-term issuance of this kind signals a pivot from asset-light models toward long-term infrastructure.

Alphabet’s deal stands out not just for its maturity but for its scale. Alphabet, Microsoft, Amazon and Meta are collectively expected to spend at least $630 billion this year, with most of that directed toward data centers and AI chips.

In that context, a 100-year bond begins to look less like a novelty and more like a financing tool for infrastructure measured in decades.

Viewed together, the signals are clear. Compute operators are spending at levels that eclipse their prior mining cycles. Utilities are formalizing record capital plans and tapping debt markets to expand generation and grid infrastructure. Earnings calls now routinely reference AI-driven load growth alongside traditional drivers.

The AI boom is not just reshaping revenue mix — it is redefining the scale and duration of capital deployment across the energy-compute stack.

Hardware and Infrastructure News

Bitcoin Miners Could Face Crisis After BTC Price Falls 50% From Peak - Decrypt

Bitcoin Mining Difficulty Saw Biggest Drop Since 2021 China Ban - TheEnergyMag

Soluna Begins Energization of Project Kati 1, adding 83 MWs to Total Capacity - Link

Bell Canada Advances AI Fabric Expansion With Proposed 160-Acre Campus South of Regina - TheEnergyMag

Corporate News

Bitfarms Deleverages, Unveils Keel Rebrand as Bitcoin Mining Margins Sink Below $30/PH/s - TheEnergyMag

Bitcoin Miner NFN8 Files Chapter 11 After Fire, Lease Strain as Hashprice Hits Record Low - TheEnergyMag

BlockFills Suspends Client Withdrawals Amid Market Volatility - TheEnergyMag

Cipher Welcomes Thomas Duda to the Company’s Board of Directors - Link

Anthropic says it will pay 100% of the grid upgrade costs tied to its AI data centers - Business Insider

Financial News

NextEra Raises $1.3B in Debt as AI Data Center Power Demand Accelerates - TheEnergyMag

Cango Sells 4,451 BTC, Cuts Bitcoin Reserves by 60% to Repay Loan - TheEnergyMag

Canaan revenue more than doubles in Q4 as bitcoin miner grows treasury to record levels - The Block

Cipher Mining and TeraWulf are buys, MARA a sell, as Morgan Stanley begins bitcoin miner coverage - CoinDesk