ABTC’s $320M Bitmain Deal: Tariffs Excluded, What’s Next?

Big hardware buy comes as tariff scrutiny intensifies

In our previous issue, we broke down how the Trump family-backed American Bitcoin’s (ABTC) 25 EH/s roadmap hinged on an option to buy up to 15 EH/s of on-rack capacity from Bitmain — the Chinese hardware giant now facing heightened tariff scrutiny in the U.S. That plan just moved from option to reality earlier this month.

After Hut 8 energized the Vega site in Texas — the flagship facility expected to host much of American Bitcoin Corp.’s (ABTC) incoming fleet — its proprietary mining subsidiary has moved to execute nearly the full option under its miner procurement deal.

Hut 8 disclosed in its Q2 earnings report that in August, ABTC agreed to purchase 16,299 Antminer U3S21EXPH units from Bitmain, totaling about 14.02 EH/s, for roughly $314 million. The deal marks a decisive step toward ABTC’s stated goal of reaching 25 EH/s.

The purchase forms part of a broader On-Rack Sales and Purchase Agreement with Bitmain Technologies Georgia Limited covering up to 17,280 miners (14.86 EH/s) for as much as $319.5 million, excluding tariffs and other import charges.

ABTC’s August tranche was funded by pledging about 2,234 BTC — valued at a mutually agreed fixed price — alongside applying a $46 million deposit already paid. The pledged Bitcoin carries a 24-month redemption period. The remaining miners under the agreement must be acquired within two months, via cash or additional Bitcoin pledges.

The move comes just weeks after ABTC accelerated its Bitcoin accumulation program, buying roughly 1,726 BTC between July 1 and August 6 for $205.6 million at an average price of $119,120. Majority-owned by Hut 8, the company now holds a significantly expanded Bitcoin reserve alongside its forthcoming hardware capacity.

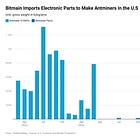

The transaction also reflects shifting dynamics in mining hardware sales. Bitmain has been working to scale up U.S.-based manufacturing to mitigate tariff risks — a growing concern as U.S.-listed miners such as IREN and CleanSpark have received U.S. Customs and Border Protection invoices for import duties on rigs CBP claims are of Chinese origin. Both IREN and CleanSpark are contesting those claims, citing supplier documentation to the contrary.

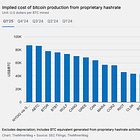

ABTC’s merger prospectus with Gryphon Digital noted that its $320 million Bitmain deal excludes any such potential charges. It remains to be seen whether Bitmain will supply U.S.-made Antminers for ABTC’s order, potentially drawing on previously reported imports of electronic components.

Even with tariffs aside, institutional demand for large-scale hardware orders has slowed as Bitcoin’s network hashrate growth plateaus, intensifying competition for sales. Earlier this month, Bitmain began marketing hosted S21e Hydro hashrate to retail buyers — a move underscoring the cooling pace of institutional purchases despite Bitcoin’s ongoing bull run.

Regulation News

Ethiopia to Wind Down Bitcoin Mining Citing Grid Strain - TheMinerMag

Mountain City leaders nix rezoning for Bitcoin facility - WJHL

Hardware and Infrastructure News

Canaan Exits Kazakhstan and South Texas Sites Amid Bitcoin Mining Fleet Reshuffle - TheMinerMag

Cango Buys 50 MW Georgia Bitcoin Mine for $19.5M in Vertical Integration Push - TheMinerMag

MARA to Acquire Majority Stake in EDF’s HPC Subsidiary Exaion for $168 Million - TheMinerMag

Bitfarms Acquires Land for HPC in US, Exits Argentina Bitcoin Mining Amid Power Supply Halt - TheMinerMag

Soluna Expands Partnership with Galaxy Digital to Deploy 48 MW at Project Kati - Link

Corporate News

Core Scientific's Top Investor to Vote Against CoreWeave's 'Inadequate' $9B Takeover - Decrypt

CleanSpark Faces $185M Tariff Risk Over Bitcoin Miner Imports - TheMinerMag

CleanSpark Chair Matt Schultz Returns as CEO; Bradford Departs With $2.53M, Bitcoin and Equity - TheMinerMag

Financial News

Rumble Mulls €1B Northern Data Takeover as Peak Mining Set for $235M Sale - TheMinerMag

Trump Family-Backed American Bitcoin Boosts BTC Reserves With $205M Purchase - TheMinerMag