The Return of HODL Despite Bleak Q2 Margins

Pure-play miners going Microstrategy route

We are now entering the earnings season for the second quarter, with Riot Platforms being the first public mining company to disclose financial and operational data. Their report paints a picture of the harsh margins of bitcoin mining in the post-halving world, a scenario likely shared by many others set to release their earnings in the coming weeks.

Riot produced 845 BTC in Q2, generating a revenue of $55.8 million, implying an average revenue of $66k per BTC. According to TheMinerMag’s analysis, Riot’s direct cost of bitcoin production after power credits was $25.3k (It would be $41.7k before power credits). The corporate overhead for the mining segment was estimated to be $27.4k based on a revenue fair share approach.

In total, Riot’s all-in mining cost amounted to $52.7k per BTC in Q2, net of power credits. This means the mining segment, which comprises 78% of Riot’s total revenue, had a net profit of $11.2 million in Q2 for a fleet of over 15 EH/s.

Besides proprietary mining, Riot has an engineering segment and some residual revenues from the discontinued hosting business. Considering all factors, the company generated a profit of just $1.22 million, net of stock-based compensation, and before depreciation and tax.

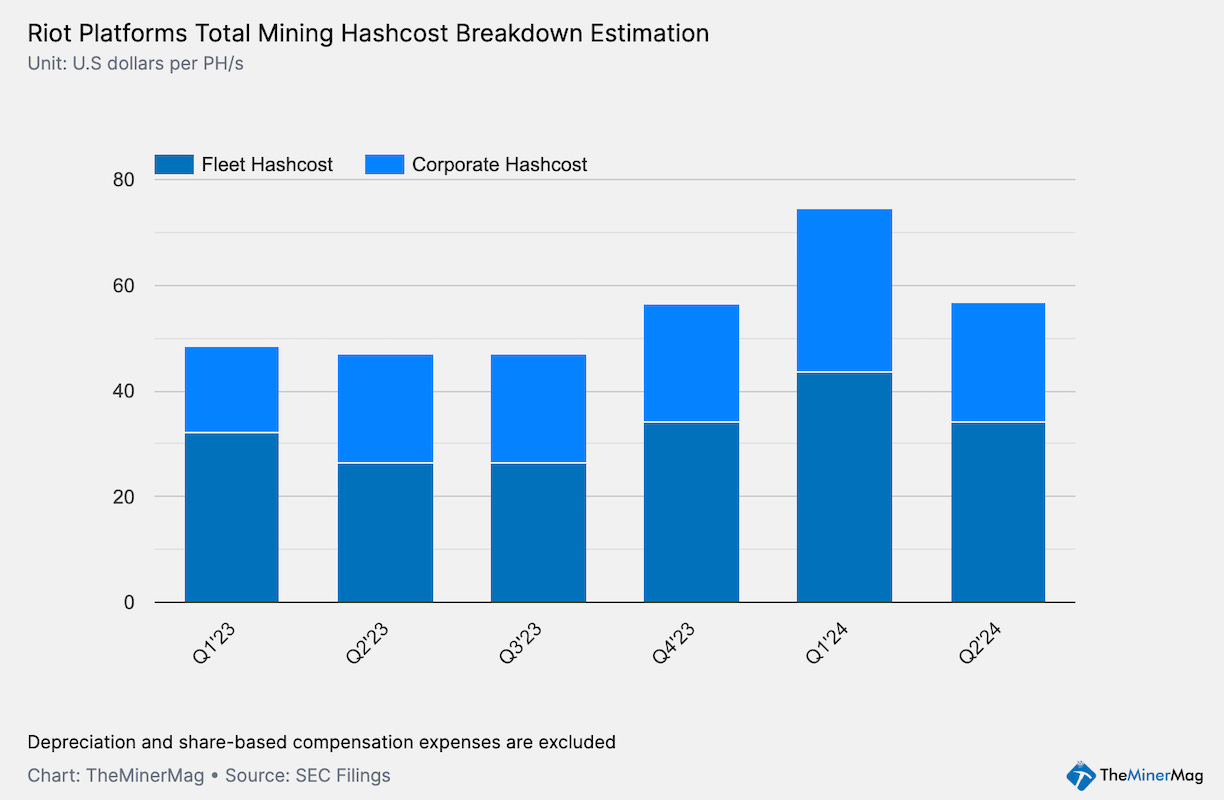

This situation is due to the brutal impact of bitcoin’s halving and the sluggish hashprice. Normalizing bitcoin’s hashrate and block rewards using the hashcost metric compiled by TheMinerMag, we see that Riot managed to reduce its hashcosts compared to Q1 as it braced for the halving’s impact. However, despite these efforts, bitcoin mining isn’t generating much cash flow at the moment for Riot, and possibly many others, due to the low hashprice below $50/PH/s.

Interestingly, pure-play bitcoin mining companies like Riot and CleanSpark did not sell any bitcoin in Q2 to cover operating costs, despite the low hashprice and margin. Instead, they raised sufficient proceeds through stock offerings to fund both capital and operating expenditures. MARA did sell some of its mined bitcoin in Q2 but announced last month that it would return to the full HODL mode.

Their bet is on the long-term appreciation of bitcoin. Riot, Mara and CleanSpark alone were holding 34,461 BTC as of June 30.

Here is the schedule of upcoming Q2 earnings:

Marathon: Aug 1, 5:00 p.m. EDT

Northern Data: Aug 6, 3:00 p.m. Central European Summer Time

Core Scientific: Aug 7, 3:00 p.m. Central Time

Cipher: Aug 13, 8:00 a.m. EDT

Hut 8: Aug 13, 8:30 a.m. EDT

Regulation News

Russia to Legalize Crypto Mining Effective November - TheMinerMag

Hardware and Infrastructure News

Auradine Ships 3-nm Bitcoin ASIC Boasting 14 J/TH Efficiency - TheMinerMag

MicroBT Launches M6XS+ WhatsMiners with 17J/TH Efficiency - TheMinerMag

Mempool Launches Accelerator for Bitcoin Transactions - TheMinerMag

Bitcoin Mining Difficulty Sets New Record Above 90 Trillion - TheMinerMag

Corporate News

Riot Increases Stake in Bitfarms to 15.9% - TheMinerMag

Power Generator Greenidge Pivots to Retain Mined Bitcoin - TheMinerMag

Bitfarms Mined 34% More Bitcoin in July Amid Rising Difficulty - TheMinerMag

Financial News

Bitcoin Miner Argo Raises $8.35M via Stock Offerings - TheMinerMag

Feature

Bitcoin miners strike back on energy [at Bitcoin 2024]- Axios

Bitcoin Miners Weathering ‘Identity Crisis’ as Some Eye AI and Acquisitions - Decrypt

Hive Digital’s AI Play - The Mining Pod

I am a Riot investor. I will read every article of yours from now on. Thank you.