30GW Pipeline Boom: Miners Bet Big on AI—But Delivery Isn’t Monetization

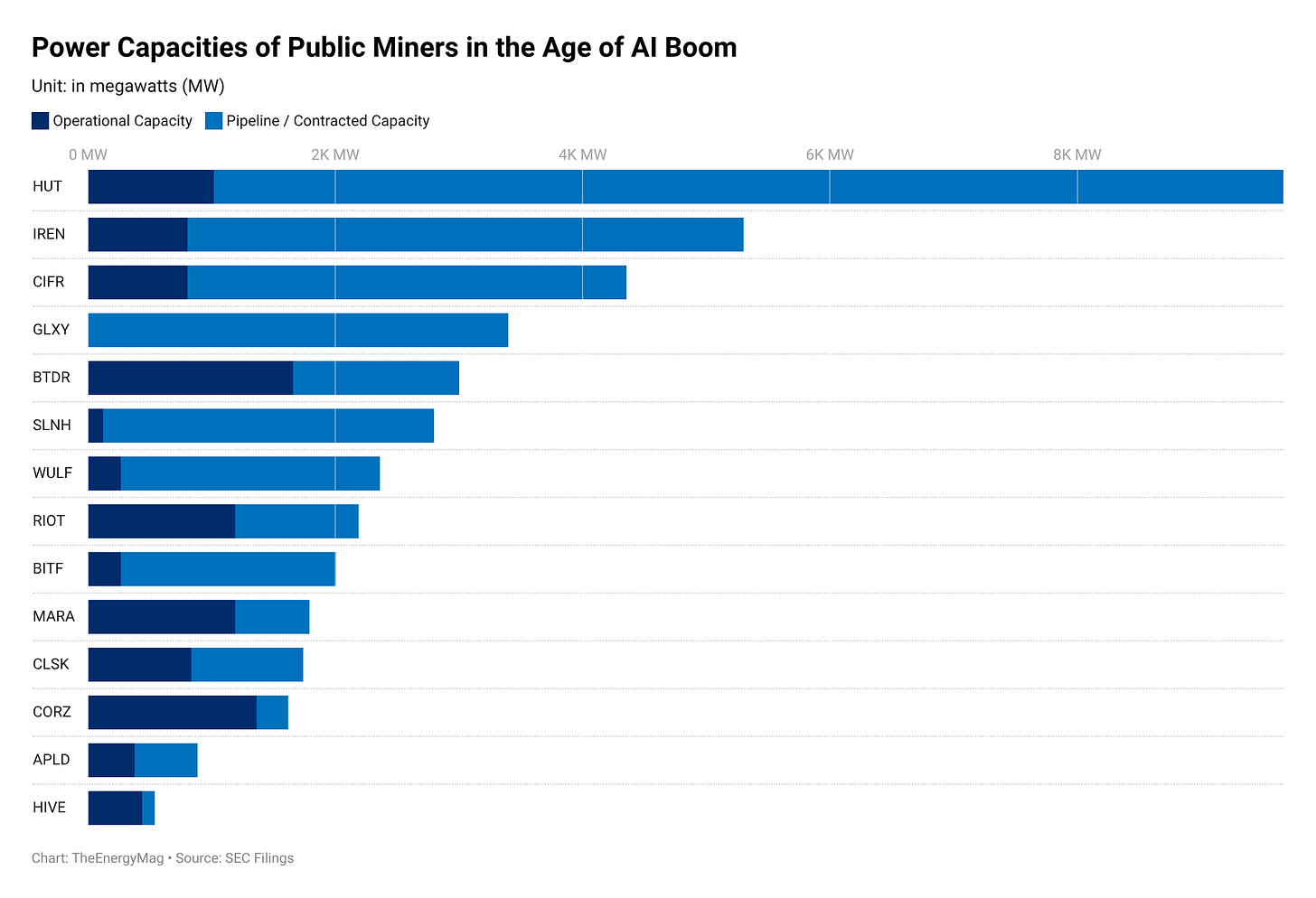

A snapshot of energized capacity and the development backlog as miners chase hyperscaler-grade load.

On paper, 14 public bitcoin miners are about to build a small country’s worth of power infrastructure.

In reality, they have roughly 11 gigawatts online today — and about 30 gigawatts more sitting in “pipeline” decks, interconnection queues, and early-stage development plans, according to the chart compiled by TheEnergyMag.

That three-to-one gap is the clearest signal yet that the mining industry’s next cycle won’t be fought only with cheaper or more efficient ASICs or higher uptime, but with something far more contested: who can secure power, finance it, and deliver data-center-grade capacity fast enough to matter.

This is the megawatt arms race of the AI boom—assuming the boom lasts long enough, and demand stays deep enough, for these companies to actually monetize the power they deliver in the first place.

But before we get carried away, it’s worth acknowledging why the bubble question is unavoidable. Every bull market comes with a new narrative that promises to lift the whole sector. In 2017, it was blockchain. In 2021, it was the hashrate arms race. In 2025, it became “AI data centers.” The story changes, the capital follows, and the industry relabels itself — often faster than the underlying business model actually changes.

Riot is a good example of that identity churn. Before 2017, it was a biotech play; then it became Riot Blockchain, rebranded again as Riot Platforms, and now faces pressure from an activist investor to accelerate its pivot away from bitcoin mining toward AI data center colocation. The names and narratives have evolved with the market cycle. The harder part is whether the assets and execution can keep up.

From GPU to ASIC and back to GPU!

The AI boom has turned “pipeline megawatts” into a valuation talking point. But “pipeline” can mean everything from a signed lease and an active construction site to a project in feasibility studies, a grid application, or simply a target a company is marketing. Some of those megawatts will become energized, revenue-generating capacity. Some will slip by years. Some will never materialize, especially if AI demand cools or financing conditions change.

Even if power delivery does catch up, there’s a second issue that doesn’t get enough attention: it’s genuinely difficult to transition from monetizing ASIC hashrate to monetizing data center infrastructure. It’s also striking to watch the industry’s arc—from GPUs to ASICs, and now back to GPUs again, but this time in a completely different business.

Capex aside, the operational and commercial risk is hard to ignore. Unlike bitcoin mining, monetizing GPUs for AI companies or enterprise customers depends heavily on product fit, sales execution, and service delivery. In bitcoin mining, the formula is simple: power plus ASICs produces bitcoin. In AI infrastructure, you can secure the power and still fail to deliver a marketable product—or fail to sell it on terms that meet customers’ expectations. That’s what makes “pipeline megawatts” a more fragile metric.

The 11 GW operational figure is part of the story that already exists. The 30 GW pipeline figure is the story miners are trying to make true. The AI pivot is a real strategic response to hashprice pressure and capital-market incentives, but it also carries the familiar scent of bull-market hype.

If the AI boom sustains, the winners won’t be the companies that announce the biggest pipelines. They’ll be the ones that can close the infrastructure gap—turning planned megawatts into energized capacity, energized capacity into critical IT load, and critical IT load into contracted revenue—without stretching their balance sheets or overpromising timelines. None of this makes the pivot impossible; it just makes it harder, and slower than the narrative often assumes.

Hardware and Infrastructure News

HIVE Signs $30M GPU Cloud Contracts to Expand Canada AI Data Center - TheEnergyMag

Caturus Secures 20-Year LNG Offtake Agreement with Aramco Trading for Louisiana Export Facility - TheEnergyMag

Mon Power and Potomac Edison Announce New Natural Gas Power Plant in West Virginia - TheEnergyMag

Transource Energy and FirstEnergy Transmission Joint Venture Approved for Major Electric Transmission Project in Central Ohio - TheEnergyMag

Soluna Expands Blockware Partnership, Adding 6 MW Bitcoin Mining Capacity at Project Dorothy 1 - TheEnergyMag

Meta to Deploy Millions of NVIDIA GPUs as AI Buildout Pushes CapEx Higher - TheEnergyMag

Yotta to Build $2 Billion AI Hub in India Using Nvidia Blackwell Chips - TheEnergyMag

Tata Group, OpenAI Plan AI Compute Hub in India - TheEnergyMag

Corporate News

OpenClaw founder Steinberger joins OpenAI, open-source bot becomes foundation - Reuters

IREN Appoints John Gross as Chief Innovation Officer to Enhance Data Center Engineering - TheEnergyMag

Portland General Electric Acquires Washington Utility Operations from PacifiCorp - TheEnergyMag

1606 Corp. Signs Term Sheet to Acquire 55 MW Texas Power Generation Facility and 50,000 Sq. Ft. Data Center-Ready Infrastructure Site - TheEnergyMag

Activist Starboard Pushes Riot to Speed Up Shift From Bitcoin Mining to AI Data Centers - TheEnergyMag

Core Scientific Board Set for Overhaul Under Two Seas Pact - TheEnergyMag

Financial News

Constellation Energy Surges 10% This Week on Data Center Deals and Analyst Upgrades - TheEnergyMag

Blackstone Commits Up to $1.2 Billion to Neysa for India’s Domestic AI Infrastructure Build-Out - TheEnergyMag

HIVE Digital Technologies Reports Record Q3 Revenue Driven by Bitcoin Hashrate Growth - TheEnergyMag

Bitdeer Plans New $300M Convertible Bonds Aimed at Deleveraging - TheEnergyMag