Bitcoin Miners Back at Survival Mode — Again

Bitcoin miners retrench as hashprice slips while AI crowd inks billion-dollar contracts

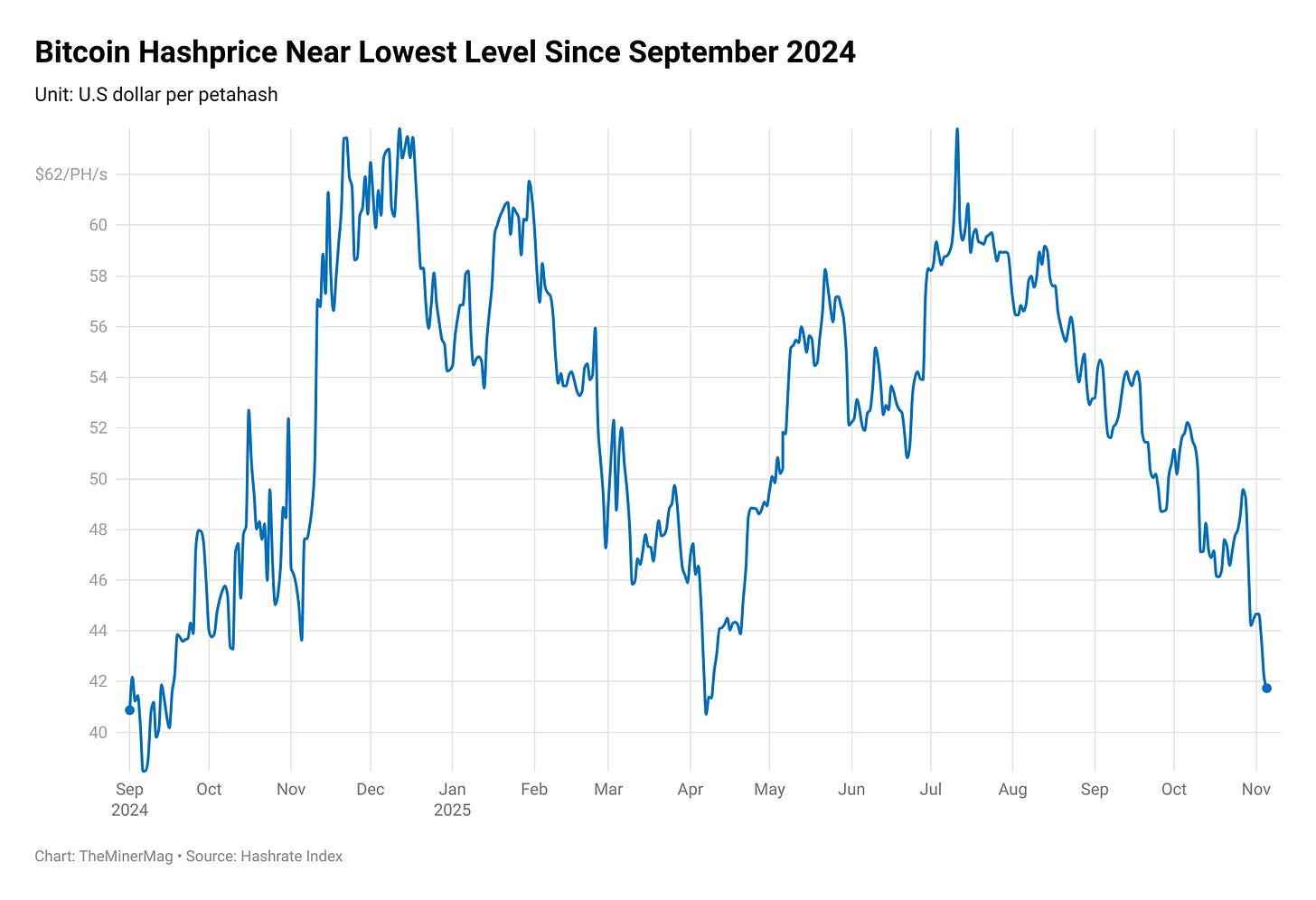

Bitcoin’s cooled off to the low $100Ks, down from those giddy $120K-plus highs earlier this year. That retracement has hashprice hovering around $42 per PH/s — flirting with the $40 line that often marks the boundary between “tight margins” and “time to unplug.”

The downturn isn’t just squeezing miners — it’s echoing upstream to manufacturers like Bitmain, which this cycle leaned heavily into bitcoin-denominated sales to keep orders flowing as the market shifted toward buyers.

Take American Bitcoin (ABTC), which pledged 2,776 BTC to finance roughly 17,000 U3S21EXPH ASICs totaling around 15 EH/s. The deal, valued near $333 million, implied an agreed-upon BTC price of about $120K.

Here’s how it works, per Hut 8’s latest 10-Q: instead of paying cash, ABTC pledged bitcoin as collateral. Ownership of those coins doesn’t transfer to Bitmain right away. As each batch of miners ships, a matching pro-rata portion of the pledge becomes “redeemable” — meaning ABTC can either buy back those BTC by paying Bitmain cash at the fixed price or let Bitmain keep them as payment for that shipment. The redemption window runs about 24 months from applicalbe pledge date.

That setup made perfect sense when bitcoin was flying. Miners could expand without dumping their holdings, and Bitmain secured large orders at strong valuations. But with BTC now near $100K, the math flips: for every shipment delivered into a weaker market, ABTC has less incentive to redeem, and Bitmain ends up being paid in coins worth less than the original invoice value.

If bitcoin slides further, Bitmain could wind up collecting BTC worth far less than what those rigs were priced at — after waiting two years for settlement. It’s not ideal, but still better than sitting on warehouses of idle inventory like in 2022.

The bigger takeaway: bargaining power has swung back to miners. This cycle, they locked in flexible, BTC-collateralized deals that shift price risk onto the manufacturer.

But miners themselves are also tightening liquidity in the current environment. CleanSpark sold 97% of its October production — its heaviest selling since the 2023 bear-market bottom — while MARA’s yield programs stumbled. Its 10,377-BTC lending book brought in $9.6 million in interest during the past quarter, but a 101-BTC net loss from a separately managed trading account with Two Prime nearly wiped that out.

And yet, across the aisle, the HPC and AI boom couldn’t look more different. IREN just landed a $9.7-billion GPU-cloud contract with Microsoft, and Cipher followed with a $5.5-billion lease deal with AWS — both announced this week. In a market where hashprice is slipping toward $40, those hyperscale commitments highlight how much investor energy has rotated from bitcoin to compute.

Regulation News

North Texas community votes against forming a city to regulate MARA’s Bitcoin mine - Texas Tribune

Hardware and Infrastructure News

HIVE Boosts Bitcoin Hashrate to 23 EH/s, Expands HPC Footprint with $1.6M Land Acquisition - TheMinerMag

Northern Data Divests Bitcoin Mining Arm Peak Mining for Up to $200 Million - TheMinerMag

Corporate News

Core Scientific Announces Termination of Merger Agreement with CoreWeave - Link

Canaan’s Japan deal marks first state-linked bitcoin mining project in the country - The Block

MARA Sues to Block Texas County Vote Creating Town Around Its Bitcoin Mine - TheMinerMag

MARA posts record $123 million profit by pairing bitcoin operations with new power and AI assets - The Block

Financial News

IREN Shares Surge 20% on $9.7 Billion Microsoft AI Cloud Deal - TheMinerMag

Cipher Stock Soars 16% on $5.5 Billion AWS Lease to Accelerate AI Expansion - TheMinerMag

Cipher Plans $1.4B Debt Offering to Fund Texas HPC Data Center Following AWS Deal - TheMinerMag

Canaan Secures $72M from Brevan Howard, Galaxy, and Weiss as Bitcoin Stocks Slide - TheMinerMag

https://substack.com/home/post/p-171590404

Check out this article if you have time.

An interesting solution to the low hashrate problem.

The Core Scientific CRWV merger termnation speaks volumes about valuation gaps right now. CRWV can probaly get better terms staying independant with all these hyperscale deals flowing. That $9.7B Microsoft contract shows the AI side is completly decoupled from hashprice concerns.