Bitcoin Mining Stocks Shed $23B as Four-Week Slide Tests the Sector’s Bull Run

See you in four years?

Bitcoin mining stocks have erased more than $20 billion in market value over the past month, raising the question of whether the sector’s sharp year-end rally is losing steam.

Around October 15, a group of 15 major publicly traded miners extended a multi-week rally that pushed their combined market capitalization to nearly $90 billion, as TheMinerMag reported at the time. But sentiment has deteriorated since. As of November 12, the cohort’s total market cap has fallen to $67 billion, a decline of 25% from the October peak.

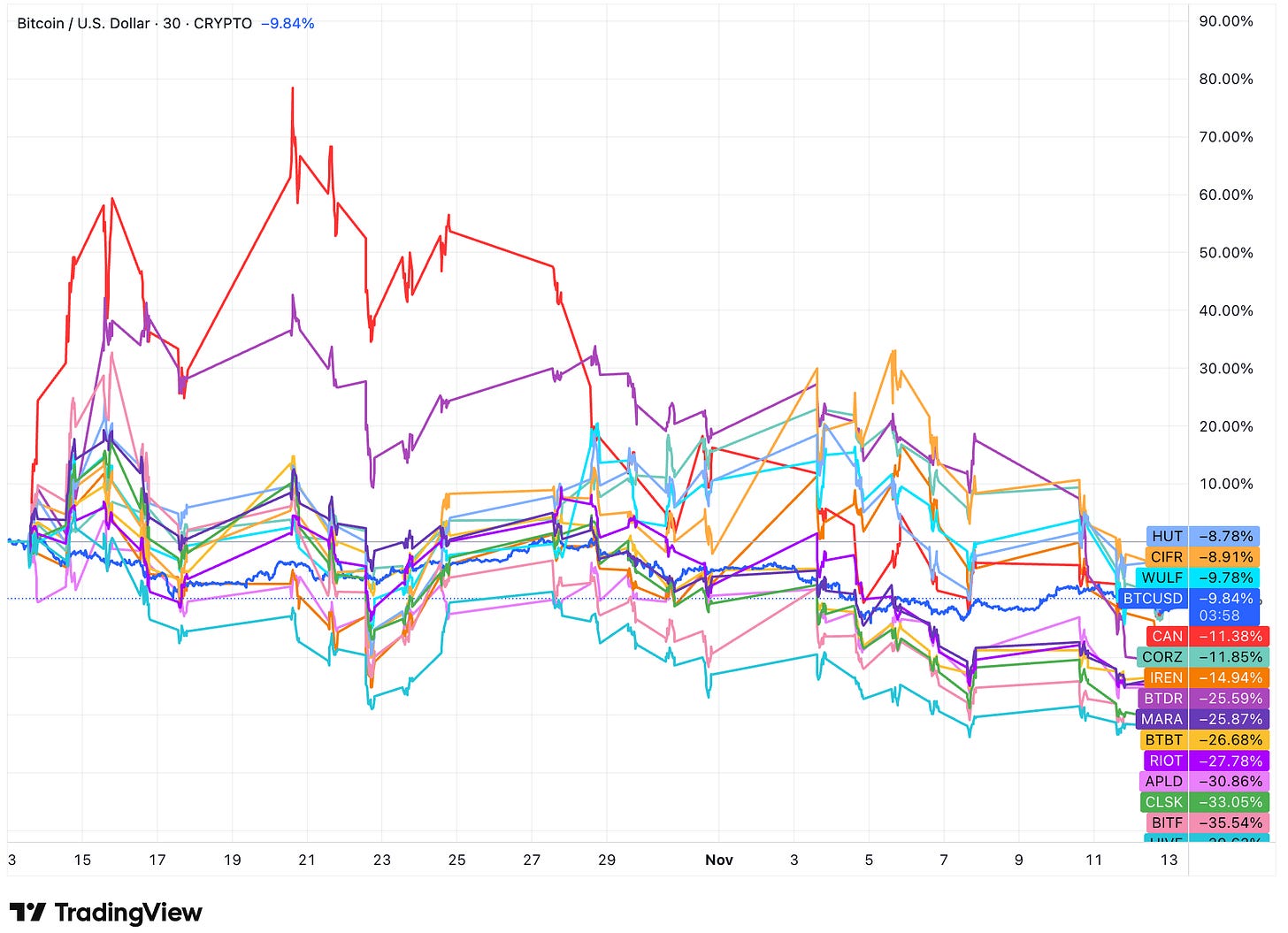

A TradingView snapshot of the period shows the sector underperforming bitcoin, with most miners falling more steeply than BTC’s roughly 10% slide over the same timeframe.

The pullback comes even as institutional investors have been accumulating mining equities. Recent Schedule 13G filings show:

Fidelity’s FMR LLC disclosed an 8% stake in Riot.

Jane Street crossed 5% ownership thresholds in Terawulf, Cipher and Bitfarms.

Barclays PLC reported a 5.27% position in Core Scientific.

Situational Awareness, a hedge fund, increased its Core Scientific stake to 9.4% in mid-October.

Institutional inflows, however, have not offset selling elsewhere. Tether trimmed 8 million Bitdeer shares, a move that likely contributed to Bitdeer’s decline during the period. More broadly, miners with weaker balance sheets or higher leverage saw outsized drawdowns as bitcoin retreated from the $120,000 range to the low $100,000s.

Despite the four-week slump, most miners remain ahead of bitcoin on a year-to-date basis. Still, the drawdown has pushed several names into oversold territory relative to BTC, a reversal from mid-October when miners were outperforming and attracting renewed speculative interest.

The divergence leaves the sector at an inflection point: is this a temporary retracement driven by macro jitters and profit-taking, or the early sign that the post-halving bull run is already fading?

With bitcoin’s hashprice hovering near cycle lows and mining economics tightening again, the next few weeks may help determine whether miners reclaim their October momentum—or whether this is another cycle where optimism peaks early, only to ask the familiar question: see you in four years?

But for some, like Bitfarms, the answer is already taking shape. The company announced on Thursday a major strategic shift to orderly wind down its bitcoin mining hashrate beginning in 2026 and repurpose its facilities in Canada and the U.S. for HPC workloads, starting with its 18-megawatt site in Washington.

Hardware and Infrastructure News

Phoenix Energizes 30MW Bitcoin Mine in Ethiopia, Expanding African Footprint - TheMinerMag

Proof-of-work Privacy Coin Zcash Continues Historic Surge, Nearing 8-Year High Price - Decrypt

Auradine Unveils New Teraflux Bitcoin Miners to Expand US Hardware Push - TheMinerMag

Corporate News

Greenidge Renews Air Permit for New York Bitcoin Mine, Ending Years-Long Legal Fight - TheMinerMag

Northern Data Moves Forward With Rumble Merger After Exchange Ratio Cut - TheMinerMag

Fire Put Out at Bitdeer’s Under-Construction Bitcoin Mine in Ohio, No Injuries Reported - TheMinerMag

MARA Pool Mines Bitcoin Block With 1 BTC Fee Paid on $10 Transaction - TheMinerMag

Bitfarms Plans to Wind Down Bitcoin Mining by 2027, Begins HPC Conversion at Washington Site - TheMinerMag

Financial News

Applied Digital Plans $2.35B Senior Notes to Fund North Dakota HPC Data Centers - TheMinerMag

CleanSpark Upsizes Convertible Bonds to $1.15B as Bitcoin Miner Debt Wave Accelerates - TheMinerMag

Tether unloads 20%of its stake in bitcoin miner Bitdeer - Blockspace.media

Bitdeer Shares Drop 22% After Pricing $400M Convertible Notes and $149M Equity Offering - TheMinerMag