CoreWeave’s AI Pivot Paid Off — $1.6B for Insiders and Counting

Nvidia’s $2B investment comes as founders continue planned share sales following the March IPO

Fresh off a $2 billion equity investment from Nvidia, CoreWeave is back at the center of the AI infrastructure narrative.

The Nvidia check — announced this week alongside a broader expansion of the two companies’ partnership — reinforced CoreWeave’s position as one of the most important pure-play GPU infrastructure operators in the market. Shares jumped more than 10% on the news and closed Wednesday at $106. That was well below a mid-June peak near $184, though it is still up 180% since its market debut.

But while the strategic endorsement grabbed headlines, SEC filings tell a longer, quieter story unfolding since the company’s March 2025 IPO.

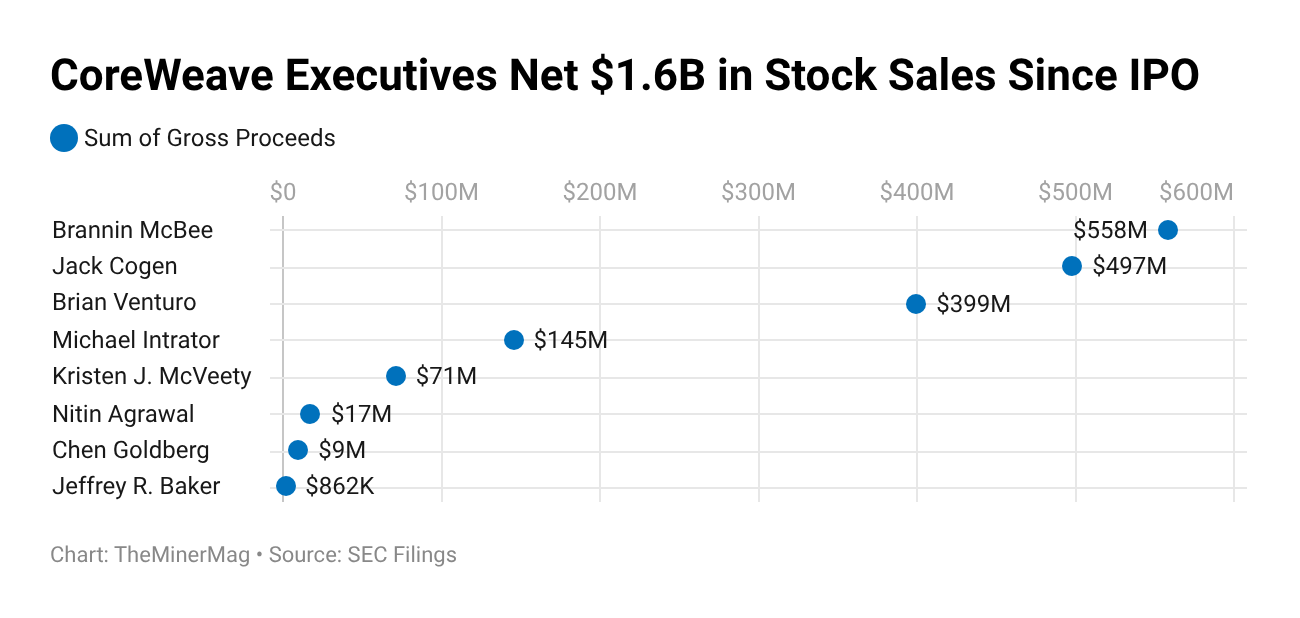

Based on Form 144 filings reviewed by TheMinerMag, CoreWeave insiders have sold roughly 17.3 million shares for about $1.69 billion in gross proceeds since going public.

That selling has been dominated by the company’s founders and senior leadership. CEO and co-founder Michael Intrator, chief strategy officer and co-founder Brian Venturo, and chief development officer and co-founder Brannin McBee together sold about 10.9 million shares for roughly $1.09 billion — close to two-thirds of total insider proceeds in the dataset.

McBee has been the largest seller among the group, unloading about 5.7 million shares for roughly $558 million. Venturo follows with about 3.9 million shares sold for around $399 million, while Intrator sold roughly 1.35 million shares for about $136 million across dozens of transactions from last fall through January. Jack Cogen, a board director since 2017 and a private investor of CoreWeave, sold about 5.35 million shares for roughly $497 million, including several large summer blocks.

Other executives also appear in the filings, though at smaller scales. CFO Nitin Agrawal, SVP of engineering Chen Goldberg and general counsel Kristen McVeety all recorded recurring sales as well. One notable absence: CTO and co-founder Peter Salanki appears to be the only co-founder among the four who has not sold shares via Form 144 filings, based on the data reviewed.

None of the insider selling is unusual on its own. Liquidity events after lockups expire are standard for newly public companies, particularly ones that have gone from crypto mining roots to tens of billions in market capitalization in under a decade.

The bulk of the founders’ share sales were executed under pre-arranged Rule 10b5-1 trading plans adopted in advance. That structure points to planned liquidity rather than reactive selling tied to day-to-day price moves or news flow.

In fact, Bloomberg reported on Oct. 10 that CoreWeave insiders had already sold roughly $1 billion worth of shares following the IPO. Based on the Form 144 filings since then, another roughly $600 million in gross proceeds has been realized in the months that followed, suggesting the selling has not slowed materially even as the stock retraced from its summer highs and Nvidia stepped in with fresh capital.

What makes this worth lingering on is where CoreWeave came from, and there’s a counterfactual lurking beneath CoreWeave’s trajectory that’s hard to ignore: Ethereum’s 2022 switch from proof-of-work to proof-of-stake, which abruptly sidelined vast amounts of GPU mining capacity.

That transition didn’t just strand hardware — it forced operators with GPU fleets, power access and operational know-how to rethink their business models. CoreWeave, which began as a GPU-focused crypto miner in 2017, was among the earliest to repurpose that infrastructure toward rented compute just as demand for AI workloads began to accelerate.

In that sense, CoreWeave’s success sits at the intersection of two structural shifts: Ethereum exiting proof-of-work and AI entering its scale-up phase. Had Ethereum continued to rely on GPU mining, it’s not hard to imagine a very different timeline — one where GPUs remained tied up securing blockchains rather than training models, and where CoreWeave’s pivot may have been slower, smaller, or unnecessary altogether. Instead, the post-merge vacuum helped turn surplus GPUs into a launchpad, setting the stage for what ultimately became one of the market’s most valuable AI infrastructure platforms.

In that sense, CoreWeave’s story will sound familiar to anyone who has watched bitcoin miners evolve over the past few cycles: power, hardware access and operational muscle mattered first, and narratives followed later. CoreWeave made the leap earlier — and with GPUs rather than ASICs.

Hardware and Infrastructure News

Bitcoin Miners Unplug 110+ EH/s to Ease Grid Strain During Arctic Blast - TheMinerMag

Bitcoin miners brace for major ice storm across southern US - Cointelegraph

Corporate News

Bitcoin miners HIVE, Bitfarm and Bitdeer downgraded as analyst warns on AI shift - CoinDesk

CleanSpark shares slide 10% as snowstorm risk, $45 million CEO pay disclosure spook investors - The Block

Amazon to Cut 16,000 Jobs in Latest Round of Layoffs - The New York Times

Bit Digital Seeks to Ease Overhang as AI Spin-Off WhiteFiber Lock-Up Expires - TheMinerMag

Financial News

Vistra Raises $2.25B for Cogentrix Acquisition Amid Growing AI Data Center Load - TheMinerMag

Nvidia Invests $2 Billion in CoreWeave as AI Data Center Buildout Accelerates - TheMinerMag

Features

Inside The Trade That Made Mike Novogratz An AI Kingpin—And Could Net Him $20 Billion - Forbes