Bitcoin Network Shrugs off China Crackdown: Impact Cut to ~20 EH/s

Pool-level data suggests about 20 EH/s remains offline after a brief network-wide dip

The latest round of speculation around a major bitcoin mining crackdown in China appears to have been amplified by social media, with network data suggesting the impact may be far smaller than some early claims implied.

The narrative gained traction after Jack Jianping Kong, a former co-chair of Canaan who now runs chipmaker Nano Labs, posted on X on Dec. 13 that bitcoin mining activity in Xinjiang was facing renewed scrutiny. Two days later, Kong said the network hashrate had fallen by roughly 100 EH/s — about 8% day over day — and estimated that at least 400,000 miners had been shut down in China. The post quickly spread and was cited by several media outlets as evidence of a large-scale Xinjiang mining shutdown.

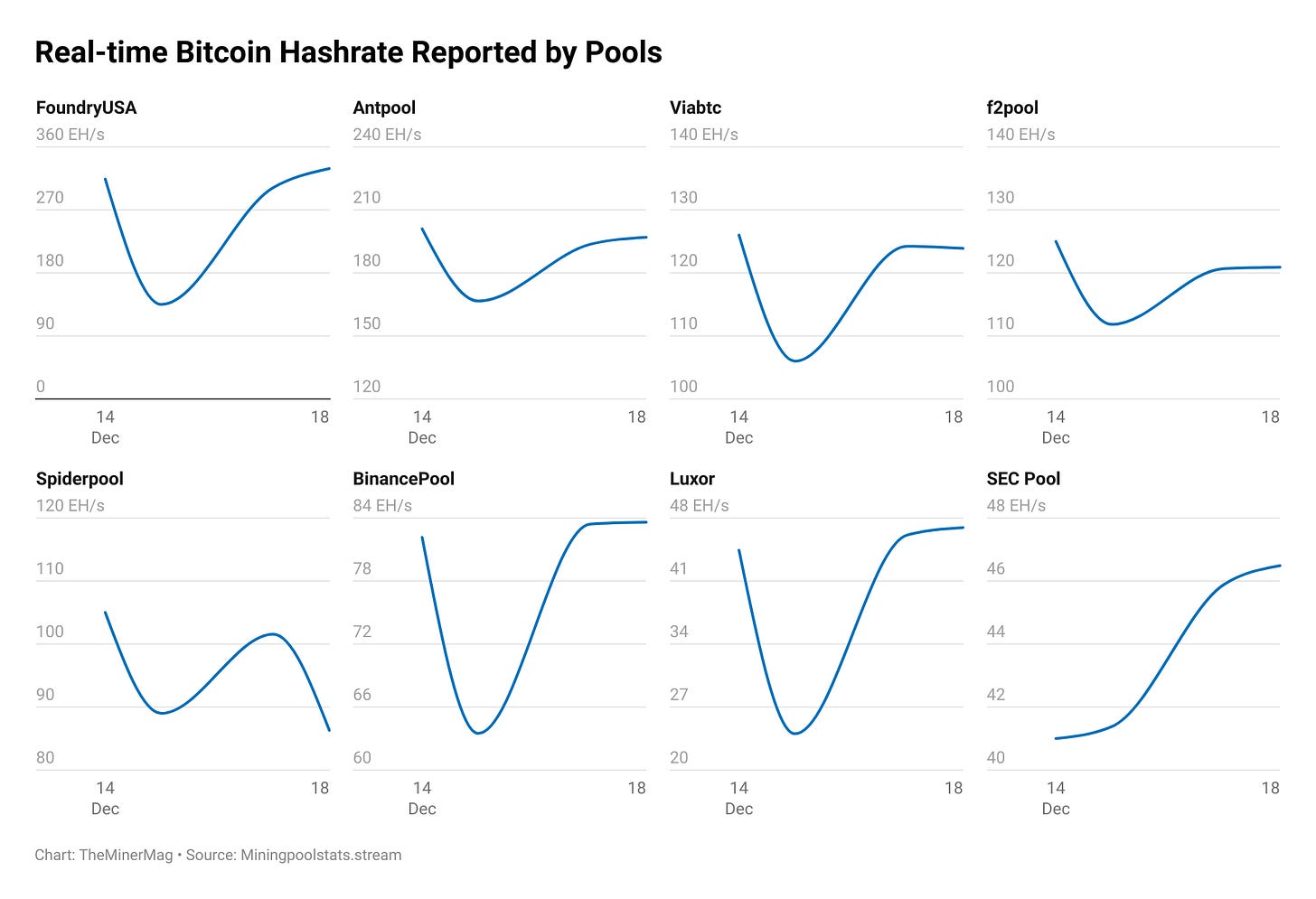

There was, in fact, a sharp hashrate dip. But a closer look at pool-level, real-time reported hashrate suggests the situation was more complex and likely conflated with unrelated events outside China.

Based on snapshots of reported pool hashrate, the steepest declines during the Monday drawdown came from North American–facing pools. Foundry USA alone saw its reported hashrate fall by roughly 180 EH/s within hours, while Luxor also recorded a sharp drop. Combined, the two pools accounted for about 200 EH/s of the total decline — a figure that closely coincides with power curtailments across parts of the U.S. over the weekend due to a cold snap.

Other large pools with Chinese origins — including Antpool, F2Pool, ViaBTC, SpiderPool and Binance Pool — collectively showed declines of around 100 EH/s. That number roughly matches the figure cited on X, but attributing the entire drop to Xinjiang would be a stretch. These pools operate globally (ViaBTC is also Russia-heavy, for instance), and some of their connected hashrate — including Bitmain-linked operations in the U.S. that connect to Antpool — could also have been affected by power curtailments outside China.

Just as important, the recovery profile does not support the idea of a whopping 100 EH/s shutdown. By Dec. 17, most major pools were reporting higher real-time hashrate levels, with the combined total sitting only about 20 EH/s below where it was before the Monday dip. That points to a largely temporary disruption rather than a sustained, region-specific shutdown.

Updated pool-level data through Dec. 18 further weakens the case for a broad, lasting shutdown tied to Xinjiang. Most major pools have now fully or nearly recovered to pre-dip hashrate levels. FoundryUSA and Luxor have rebounded above their Dec. 14 readings, reinforcing the view that U.S. power curtailments were a major driver of the initial drawdown.

Among China-origin pools, Antpool and f2pool remain down by only a few exahashes compared with earlier in the week — a gap that appears marginal in the context of normal operational fluctuations. SpiderPool stands out as the main exception. As of Dec. 18, its reported hashrate remains roughly 20 EH/s below levels seen before the dip, making it the only major pool showing a sustained decline.

That divergence may offer a more realistic signal of Xinjiang-related disruptions. SpiderPool’s continued weakness suggests it may have had a relatively higher concentration of miners operating in the region who were forced offline and have yet to return. Even so, the scale implied by the data points to low tens of exahashes rather than the roughly 100 EH/s cited in early social media posts.

With that being said, it is plausible that some miners in Xinjiang may have voluntarily powered down over the weekend to stay under the radar during inspections, then quietly came back online as scrutiny eased. If so, pool-level recovery would mask short-lived regional shutdowns that never showed up as a lasting network deficit.

The timing made the episode particularly noisy. U.S. cold-weather curtailments and Xinjiang inspections unfolded almost simultaneously, creating a perfect storm for over-attribution in social media narratives.

What does stand out more clearly is that enforcement activity in Xinjiang may be hitting non-bitcoin mining harder. Litecoin’s hashrate, for example, fell sharply on Monday, dropping from about 3.38 PH/s to 2.65 PH/s — a roughly 20% decline — and has yet to meaningfully recover. That suggests the resurgence of mining in the region has not been limited to bitcoin, and that other proof-of-work networks may be more exposed.

The bottom line is that there is little doubt some level of shutdown activity occurred in Xinjiang, but claims that as much as 100 EH/s of bitcoin hashrate disappeared there appear overstated when viewed through pool-level data. That said, this does not mean inspections in Xinjiang will not intensify in the near term.

Recent activity suggests that mining in remote parts of Xinjiang has been tolerated as long as operators kept a low profile. Public bragging about those operations on Chinese social media, however, appears to have drawn unwanted attention — and may have ultimately triggered a broader response.

Regulation News

Arizona city unanimously rejects AI data center after residents’ outcry - Fox Business - Fox Business

Bitcoin mining ban welcomed by power-depleted Russian regions - DLnews

Hardware and Infrastructure News

Lucky solo bitcoin miner beats 1-in-82-year odds to win $285,000 block reward - The Block

Sangha Energizes 20 MW Texas Solar Bitcoin Mine Amid Record-Low Hashprice Pressure - TheMinerMag

Corporate News

Bitdeer Lifts November Bitcoin Output as Mining Sites Begin AI Data Center Conversions - TheMinerMag

Canaan Inc. Renews Its US$30 Million Share Buyback Program - Link

Weather Disruptions Delay CoreWeave, Core Scientific AI Data Center in Texas: Report - TheMinerMag

Hut 8 Shares Jump 20% After $7B Fluidstack AI Data Center Lease - TheMinerMag

Feature

We mapped the world’s hottest data centers - Rest of World